Forex Trading Basics: A Beginner’s Guide to Success

For anyone looking to delve into the world of finance, forex trading presents a unique opportunity. As the largest and most liquid financial market in the world, the foreign exchange (forex) market allows traders to buy, sell, exchange, and speculate on currencies. However, for beginners, navigating this expansive and often complex realm can be daunting. In this guide, we aim to simplify forex trading basics and provide a solid framework to kickstart your trading journey. If you’re pondering your first steps, a good place to begin is understanding key terminologies and concepts that define this marketplace. Additionally, leveraging resources such as forex trading basics beginners guide Forex Brokers in Jordan can be beneficial in finding reputable platforms for trading.

Understanding Forex Trading

Forex trading involves the simultaneous buying of one currency and selling of another. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar) and GBP/JPY (British Pound/Japanese Yen). The first currency in the pair is known as the base currency, while the second is the quote currency. The price of a currency pair reflects how much of the quote currency is needed to purchase one unit of the base currency. Understanding this fundamental principle is crucial for any aspiring trader.

Market Participants

The forex market is composed of various participants, including central banks, commercial banks, financial institutions, hedge funds, and retail traders. Each of these players has different motivations and strategies, leading to a dynamic trading environment. Retail traders, or individual traders, are often new entrants seeking profit opportunities by leveraging changes in currency prices. Recognizing the roles of different participants can provide valuable insights into market movements.

Currency Pairs

As previously mentioned, currencies are traded in pairs. There are three primary categories of currency pairs:

- Major pairs: These pairs include the most traded currencies, such as EUR/USD, USD/JPY, and GBP/USD. They generally have higher liquidity and lower spreads.

- Minor pairs: These consist of less commonly traded currencies, not including the US dollar, such as EUR/GBP and AUD/NZD.

- Exotic pairs: These pairs involve a major currency paired with a currency from a developing economy, like USD/TRY (Turkish Lira) or EUR/ZAR (South African Rand). Exotic pairs often exhibit higher volatility and wider spreads.

How to Start Forex Trading

To embark on your forex trading journey, follow these steps:

- Educate Yourself: Knowledge is power in forex trading. Familiarize yourself with trading concepts, strategies, and market analysis techniques.

- Select a Reliable Broker: Choose a forex broker that is reputable and compliant with regulatory standards. Consider factors such as trading platforms, transaction costs, and customer support.

- Open a Trading Account: Setting up a trading account with your chosen broker is relatively straightforward. Most brokers offer demo accounts that allow you to practice trading with virtual money before risking real capital.

- Develop a Trading Plan: Create a detailed trading plan that outlines your goals, risk tolerance, and strategies. This will serve as your roadmap in the fast-paced forex market.

- Start Trading: Once you’re comfortable with your plan and platform, you can start trading. Always start with a small investment to mitigate risks.

Technical and Fundamental Analysis

Successful forex trading requires an understanding of both technical and fundamental analysis:

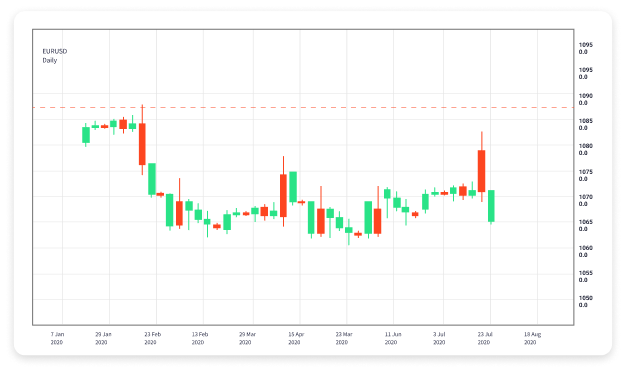

- Technical Analysis: This involves analyzing price charts and using historical price data to identify patterns, trends, and potential price movements. Technical indicators such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) are commonly employed.

- Fundamental Analysis: This encompasses examining economic indicators, news releases, and geopolitical events that can influence currency values. Economic reports such as GDP growth, unemployment rates, and interest rate changes are vital to understanding market sentiment.

Risk Management

Risk management is critical in forex trading. Successful traders employ various strategies to protect their capital and minimize losses, including:

- Setting Stop-Loss Orders: A stop-loss order allows you to specify a price at which your position will automatically close to prevent excessive losses.

- Position Sizing: Determine the appropriate amount of capital to invest in each trade based on your overall capital and risk tolerance.

- Diversifying Investments: Avoid placing all your capital in a single trade or currency pair to spread risk across multiple assets.

Common Mistakes to Avoid

As a beginner, it is crucial to be aware of common pitfalls in forex trading:

- Overleveraging: Many new traders make the mistake of using excessive leverage, which can amplify both profits and losses. Always use leverage judiciously.

- Emotional Trading: Trading based on emotions such as fear and greed often leads to poor decision-making. Stick to your trading plan.

- Ineffective Analysis: Failing to properly analyze the market can lead to unexpected losses. Always conduct thorough technical and fundamental analysis.

Conclusion

Forex trading can be both rewarding and challenging. As a beginner, it is essential to approach the market with an open mind and a commitment to continuous learning. By understanding the fundamentals, developing a solid trading plan, and practicing effective risk management strategies, you can increase your chances of success. Remember that every trader started as a beginner, and with patience and diligence, you can navigate the forex market like a pro.

Comentarios recientes